We’re not getting political—just practical, and this is our one deep dive.

When Trade Gets Techy: Why We’re Talking About Tariffs

We’re not in the habit of diving into politics here at TechInform. But this one? It’s hard to ignore.

The U.S. just dropped a sweeping set of tariffs that hit nearly every major trade partner in some way, and for the tech industry — which relies heavily on overseas manufacturing, materials, and labor — it’s not just noise. It’s impact. Real impact.

Normally we’re writing about smart frameworks, slick tools, and what’s new in the stack. But lately, the background noise of the industry has gotten a little louder — pricing shifts, product delays, weird glitches in supply chains. And after poking around to connect the dots, it’s clear: this new tariff policy is a major part of the story.

This is our one deep dive on it. No partisan angles. No policy punditry. Just the facts, and how it’s showing up in real-world tech.

A Trade Shock in Two Parts

Let’s walk through what actually happened.

On April 5, the U.S. rolled out a blanket 10% tariff on all imported goods. That’s the floor — no matter where a product comes from, it now costs 10% more at the border than it did a week ago.

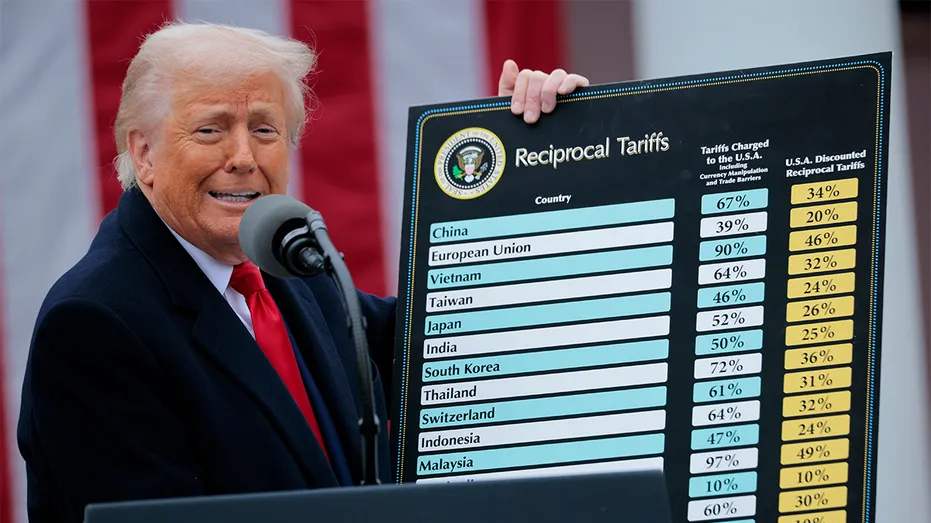

Then, on April 9, a second wave hit: “reciprocal tariffs”. These are extra taxes added on top of the baseline 10%, and they’re based on how much each country already taxes U.S. exports.

In other words: if your country slaps 40% tariffs on American goods, the U.S. is now responding in kind. Here’s how that breaks down for a few key players:

- China: Already had a 20% tariff. Now gets an extra 34%, plus a possible 50% more if things escalate — for a total of up to 104%.

- Vietnam: 46% tariff

- Cambodia: 49%

- European Union: 20%

- Australia: Just the 10% baseline

The justification from the administration is that this levels the playing field — if other countries tax us heavily, we’ll tax them back. “Reciprocal,” in their words.

Economists, though, are sounding alarms. Tariffs this aggressive tend to spark retaliatory moves, and that’s exactly what we’re already seeing. China, for example, announced its own 34% tariff on U.S. imports, plus tighter restrictions on rare earth exports — which are hugely important in tech manufacturing.

What It Means for Tech (Spoiler: It’s Not Great)

Most industries will feel these tariffs eventually, but tech is catching the first wave — and catching it hard.

That’s because our devices, infrastructure, and components are all built on deeply global supply chains. From the logic board in your MacBook to the batteries in EVs to the cloud servers powering this website, there are very few pieces of tech made entirely within one country anymore.

Here’s where the pressure is building:

1. Hardware and Devices Are Getting More Expensive

Nearly every laptop, smartphone, tablet, or smart home device is either manufactured or assembled in Asia. A huge chunk of that happens in China and Vietnam — two countries now facing massive import tariffs. Even companies that “design in California” are sourcing parts and manufacturing labor from these now-tariffed zones.

Expect prices to rise, even if not immediately. And if you’re a small device maker, this is a huge hit to margins.

2. Chips Are Caught in the Crossfire

The global semiconductor industry is already under strain. Between post-pandemic demand shifts and recent export controls, the supply of chips was just starting to normalize. Now, with tariffs and retaliatory bans (like China’s squeeze on rare earth exports), we’re seeing new cracks emerge.

Even if chips are designed in the U.S., many are fabricated, packaged, or tested in Asia. That makes them subject to multiple rounds of import/export taxation.

3. Infrastructure Just Got More Expensive

This one hits close to home: servers, networking equipment, and industrial hardware are overwhelmingly built in China and Southeast Asia. As we plan for the future of TechInform — more traffic, more tools, maybe some smart hosting integrations — we’re now having to rethink our infrastructure roadmap.

Simply put, the servers we’ll eventually need now cost more. A lot more. And with everything from fans to power supplies caught in the same supply loop, it’s not as easy as switching suppliers.

4. Supply Chains Are Shifting—But Not Fast Enough

Some companies will try to pivot — maybe source from Mexico or assemble in India. But these aren’t quick moves. Building reliable electronics manufacturing takes time, labor, and logistics. Short term, that means delays. Long term, it could mean a reshuffling of the global tech map.

5. Clients Are Pulling Back

Beyond TechInform, we do work with other orgs in the tech space — and lately, those conversations have taken a turn. With the stock market wobbling and overall uncertainty rising, some clients are pausing spend, delaying tool upgrades, or postponing product launches. The ripple effects are already reaching the edge of the pool.

Trevor Score: 3/10 — Necessary or not, this is messy and expensive

This isn’t a formal review — it’s just how I felt using (and navigating) this new trade environment. A gut-check from someone who actually felt it in their tech stack.

Trevor Score: 3/10 — I get that there’s a case to be made for trade reform. But from a tech perspective, this roll-out is all pain, no planning. It’s hitting essential parts of the pipeline with little room to adapt — and even less time to do it well.

Prices are rising, projects are stalling, and the uncertainty makes it hard to plan for anything longer than a quarter out.

Final Verdict: Tariffs Are Now a Tech Problem

We’re not trade policy people. But we are tech people. And from where we’re sitting, this wave of tariffs is already reshaping how gear gets made, how companies plan their launches, and how infrastructure gets built.

If you’re building in tech, selling in tech, or scaling a platform, this matters. Not in an abstract, “someone should care” kind of way — in a “your BOM just got wrecked” kind of way.

This is the one and only deep dive we’re doing on the U.S. tariff situation — unless something major changes. Until then, we’re watching, adapting, and staying focused on what we can build despite the turbulence.

We’ll Leave the Trade Wars to the Suits

Thanks for sticking with this one — I know it’s not our usual vibe. But sometimes the backend of tech gets weird, and this is one of those moments.

Now, back to the good stuff: new AI tricks, smarter workflows, and maybe even a teardown of that wild transparent handheld console we’ve had our eye on. Stay tuned.